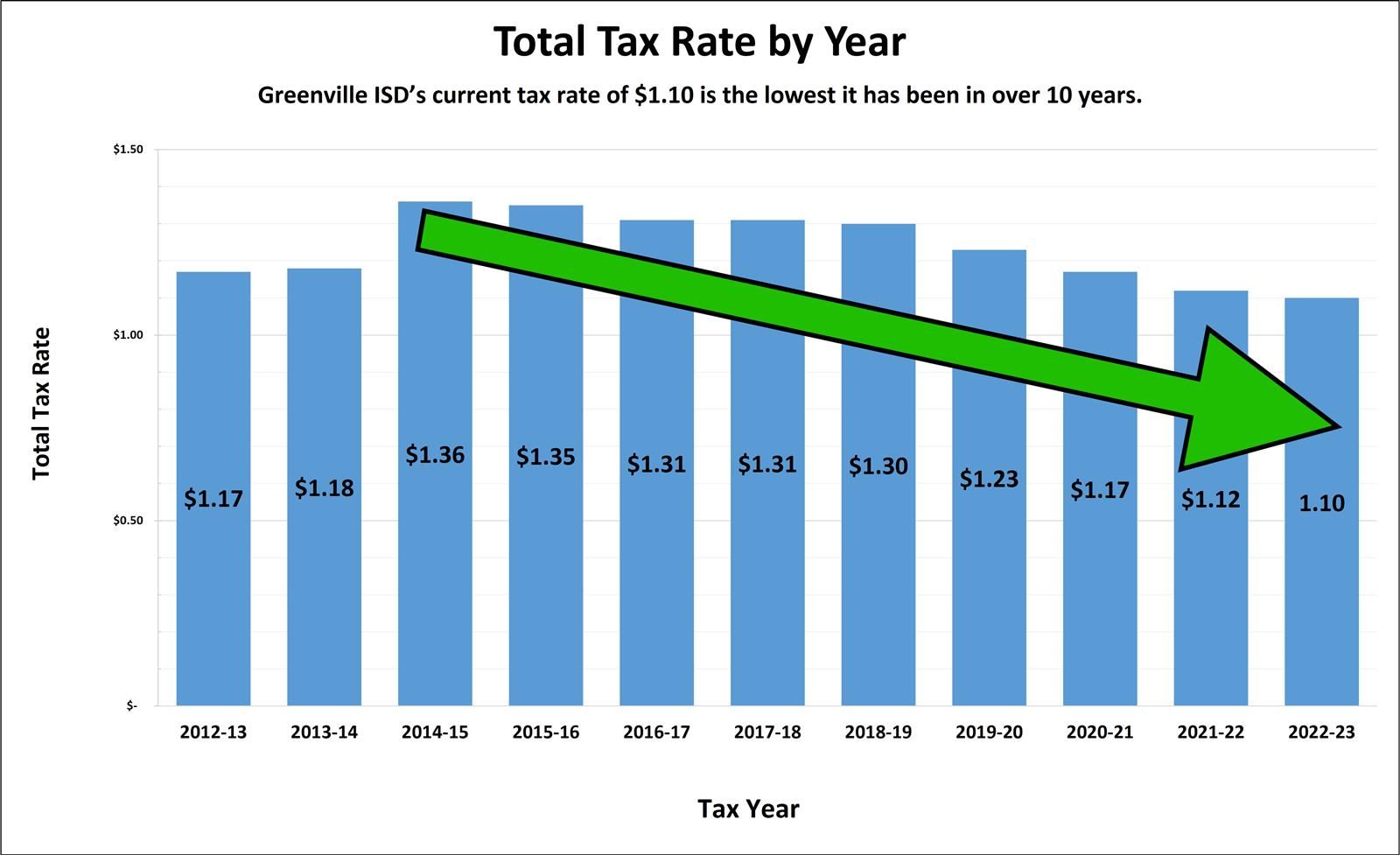

GISD School Board reduces tax rate to lowest in over 10 years

August 23, 2022

| Year | Maintenance & Operations | Interest & Sinking | Total |

| 2022-23 | $0.8646 | $0.238481 | $1.103081 |

| 2021-22 | 0.882 | 0.238481 | 1.120481 |

| 2020-21 | 0.9302 | 0.238481 | 1.168481 |

| 2019-20 | 0.99 | 0.238481 | 1.228481 |

| 2018-19 | 1.06 | 0.238481 | 1.298481 |

The Greenville ISD property tax rate is made up of two parts: the Maintenance and Operations (M&O) rate and the Interest and Sinking (I&S) rate. M&O funds are used for salaries and daily operations. I&S funds are designated for paying the principal and interest on voter-approved bonds used for capital improvements, such as buildings and construction projects.

In other financial news, GISD received a preliminary rating of 98 for the financial accountability rating system. The annual rating is given by the state's school financial accountability rating system, known as the School Financial Integrity Rating System of Texas (FIRST). The rating system is designed to ensure that Texas public schools are held accountable for the quality of their financial management practices and that they improve those practices.

“We are proud of the excellent fiscal stewardship practiced by our Board of Trustees and our Finance Department,” Superintendent Sharon Boothe said. “We have earned top ratings in this area for several years in a row.”