Attorney General's office releases forensic audit from March 2018

January 28, 2022

The Attorney General’s office has released the forensic audit from 2018. The document examines financial and personnel practices dating back eight years or more.

As you may remember from my “real talk” column, GISD’s trustees and I fully support the release of the forensic audit. Until now, we were bound by law to follow the directive of the Attorney General, whose office had ruled that the audit should not be released because of pending criminal investigations. We contacted the Attorney General’s office again last week to request that the forensic audit be released. They reviewed the status of their work and provided us permission to release the audit.

As superintendent, I try to always lead with a focus on the future. At the same time, I realize it is important to learn from the past in order to put the right practices in place for the future. I have studied the audit, and I believe it sheds light on past practices that continue to draw criticism today.

That brings us to the audit itself, which was performed by CPA Columbus “Sandy” Alexander III, a certified fraud examiner. Following extensive interviews and scrutiny of financial and personnel records, Mr. Alexander arrived at the following conclusion:

“The current GISD Superintendent (Dr. Demetrus Liggins) inherited a mess created by years of incompetence, neglect and mismanagement. There were examples everywhere of residual, carryover issues from the former GISD Superintendent’s administration.”

As you’ll find in the lengthy report and exhibits, the auditor made the following recommendations for fiscal and administrative improvement in 2018. Because the audit was authored about four years ago, I want to share the summary of findings, along with the corrective actions that GISD’s leadership team has taken since 2018.

- The finding: Bartlett Cocke, the Construction Manager at Risk (CMR), was paid via wire transfer during the period from Oct. 15, 2014 to Nov. 29, 2017.

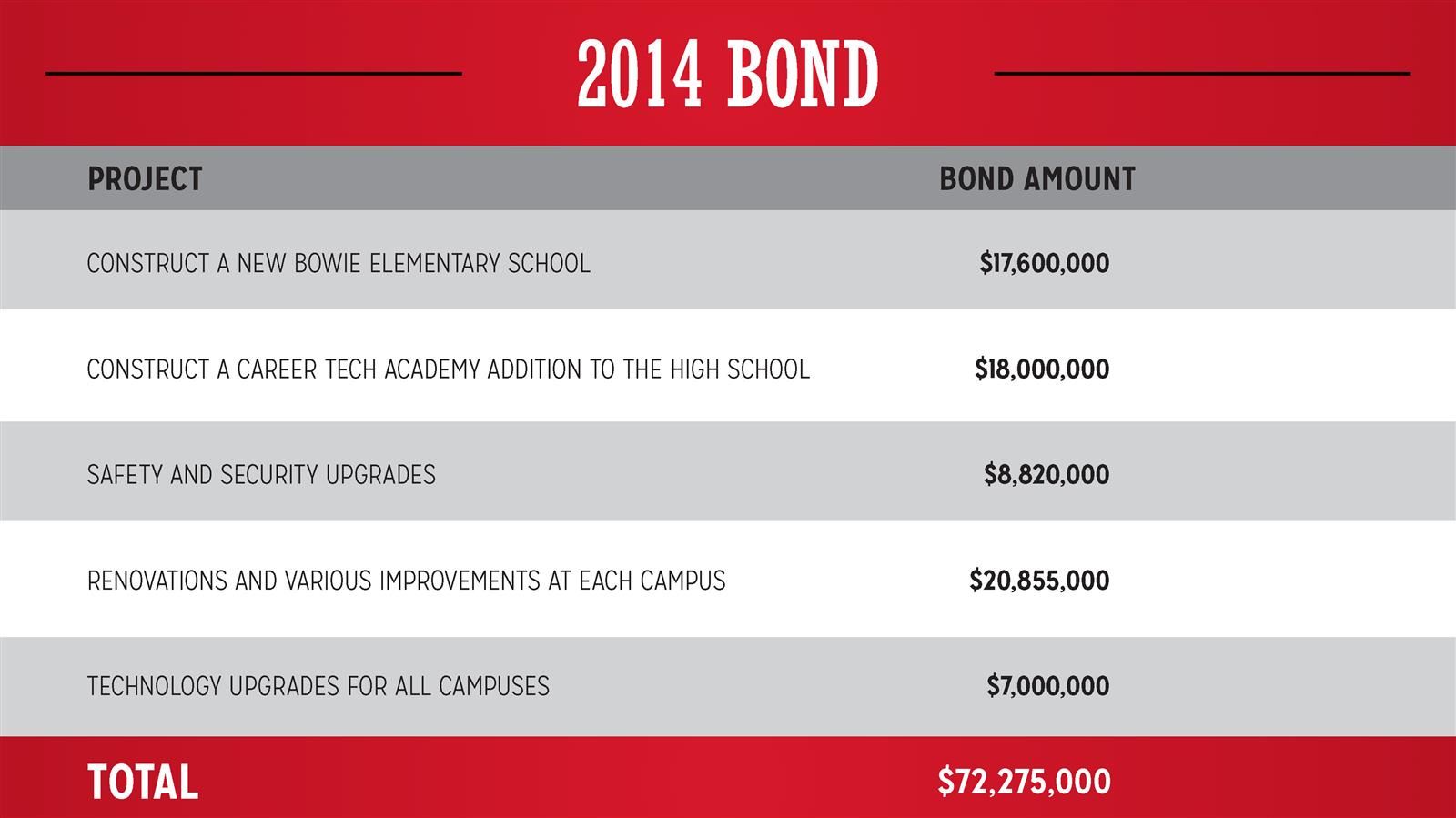

Bartlett Cocke was hired to manage the construction of the bond projects listed below.

The forensic auditor was concerned that GISD staff did not possess the detailed receipts that would be needed for an internal reconciliation.

State statute and best practice require the CMR to manage the bidding process, retention of all records and payments to subcontractors. They follow the bid results and provide the board with a schedule of values for each project bid package reflecting the breakdown of scope components (ex. site work, steel, concrete, masonry, roofing, etc.). The schedule of values is utilized from start of construction through the end of construction to determine appropriate payment to the CMR.

To follow the forensic auditor’s recommendation, GISD contacted Bartlett Cocke requesting all invoices and financial records related to the GISD projects. The district planned to hire an external CPA to audit the invoices and records from Bartlett Cocke that represented the allocations. Unfortunately, the external CPA was unable to begin work because an investigator hired by the Attorney General’s office took possession of all GISD materials related to Bartlett Cocke, which included invoices and records. Therefore, the external CPA audit of the Bartlett Cocke invoices and records could not be conducted. Those records remain at the AG’s office today. Now that the AG’s office has allowed us to release the audit, we are pursuing regaining possession of the boxes of financial records from the 2014 bond.

This is where the myth of the “missing money” comes from. The point the forensic auditor was making was that at the time he was interviewing staff, the Finance Department could not produce a paper trail for all expenditures to the level of detail he was requesting because those records were at the offices of Bartlett Cocke. There is a vast difference between “missing money” and a lack of detailed source documents.

If $57 million were missing, the projects would never have been completed because there would not be funds to pay for a new Bowie Elementary, CTE addition to the high school or any of the other major projects that are detailed in this report.

There are many other protection measures for bond expenditures, including a surety bond, which ensures that the contractual obligations made by the entity hired to perform the services (in this case, Bartlett Cocke) completes the services and delivers payment to all subcontractors. The surety bond protects both GISD and the subcontractors hired by the CMR.

2. The finding: Comingling of payroll and vendor payments, which is contrary to best practices. The auditor recommended establishing a separate account for use in payroll and that each bank account be reconciled monthly, and that procedures for reconciliation be improved to include the inspection of canceled checks and deposit slips.

Today: Payroll, which makes up more than 80% of our annual budget, is paid out of a completely separate account from all other expenditures. Those other expenditures include utility payments, maintenance, transportation and food service costs, payments to vendors, and all other expenses.

Please note, finding 2 is unrelated to the 2014 bond issue. It, and all the other findings, pertain to the general fund, which pays for day-to-day operations.

3. The finding: Payroll overpayments. The auditor found that six GISD former employees had been overpaid due to the failure on the part of the HR clerk to update their Skyward information to reflect that they were no longer employed in GISD. Those six former employees continued to receive paychecks. Upon discovery of the error, the former employees were contacted, and arrangements were made for them to reimburse the district. Another clerical error resulted in the overpayment of salary to an active employee. The error was detected and corrected in 2017. The auditor also noted that three employees had multiple increases to their salary over a short period of time.

Today: None of the people involved in the overpayment are still employed by GISD. We have systems in place to avoid a recurrence of the error, which includes Payroll and Human Resources working together in checking terminated employees’ files against payroll to make sure the terminated employees are no longer being paid. Also, at the beginning of each school year, rosters from campuses and departments are compared to payroll to ensure accuracy. Salary increases are evaluated by the Assistant Superintendent of Finance, the Chief of Human Resources and then, the Superintendent. All three must approve for the salary increases to occur.

4. The finding: Lack of reconciliation between Skyward and Aesop

Today: We perform monthly reconciliations to verify that employee absences are properly recorded in Skyward, and they align with substitute records that are stored in Aesop. In the event the requested absence does not require a substitute, the report of absence by the employee is reconciled against Skyward records monthly. This process occurs both on campuses and in GISD Departments.

5. The finding: CPA firm adjusting journal entries at end of year

Today: To ensure that journal entries are made in a timely manner, we reconcile all expenditures on a monthly basis. Monthly financial reports are presented at regular school board meetings. Our Finance Department has received high marks on its annual audit in recent years. GISD has also received an A rating from the State of Texas for several years.

6. The finding: Budget variances

In 2016-17, the approved budget was $40.8 million, and actual expenditures totaled $47.2 million. $3.5 million of the overspending was due to expenses related to the old Paris Junior College building on Jack Finney. Also, grant-funded positions did not roll off payroll after the grant expired. As a result, the following occurred:

- A sharp drop in fund balance

- No raises for staff during the 2017-18 school year

- Academic programs were evaluated for spending per pupil, and programs were eliminated, scaled back and delayed to save money.

- A reduction in force was enacted in the spring of 2018.

Today: GISD has a balanced budget and a healthy fund balance. In addition to monthly financials, grant allocations are reported to the board quarterly.

The GISD budget for 2021-22 is $50.5 million, more than 80 percent of which is devoted to paying our teachers and staff. The district has a healthy fund balance that ensures fund availability in case of emergencies.

In addition, the forensic auditor recommended that:

- The Business Manager position be eliminated and replaced with a CPA Controller.

He also recommended succession planning for the important role as Chief Financial Officer. GISD hired CPA Deidra Reeves, who diligently worked to ensure that GISD returned to good financial health. Ms. Reeves hired and trained current Assistant Superintendent of Finance Sherry Dodson, who was able to move into the role seamlessly.

- A review of GISD Accounting, Human Resources and Communications Department roles and responsibilities for possible personnel realignment, replacement or reduction in order to improve administrative performance.

GISD followed this recommendation. - A rotation of CPA audit firms every three to five years while keeping Rutherford, Taylor & Company for at least one additional year to ensure stability in GISD financial reporting, and continuity during staff change.

Requests for Proposals (RFPs) were posted, and GISD determined that Rutherford Taylor best met the criteria. To meet the rotation recommendation, Rutherford Taylor changes the audit team members every year.

There were additional findings related to professional conduct and ethics. They include two key findings:

- The auditor found that former HR Executive Director Ralph Sanders “repeatedly exhibited extremely and inexplicably poor judgment in connection with employment matters involving former employee Tevin Brookins.” The Attorney General’s Office investigated and charged Sanders and Brookins with theft of property by a public servant. Brookins served time in jail, and Sanders was ordered by the court to pay restitutions. It was determined that a total of $1,580.16 was stolen from GISD due to payments made to Brookins after he severed his employment with the district.

- HR personnel discovered that then-Director of Community Relations Sydney Hanner was overpaid by $12,762.28. HR personnel corrected payroll records to reflect Hanner’s correct yearly salary. However, at the time of the audit, Hanner had not reimbursed GISD for the past overpayment. During interviews with the forensic auditor, there were contradictory statements made by individuals about whether Hanner was instructed to keep the money or pay it back. Subsequently, GISD arranged to have the money repaid by Hanner.

In conclusion, I much prefer to focus on the future rather than the past. That being said, transparency and accountability are two key values for the School Board and for me. The GISD’s trustees and I fully support the release of the forensic audit. In order to move forward, we felt it was important to release this report from 2018 so that all the facts can be known. We owe it to our community – and most of all, to our students – to continue to focus on our mission of preparing students for future success.

Please note: A small portion of information has either been redacted or withheld in accordance with the attorney-client privilege and other exceptions under law. This information includes but is not limited to attorney-client communications, personal data, and proprietary information.

To read the forensic audit in its entirety click HERE.